Charitable Remainder Annuity Trust

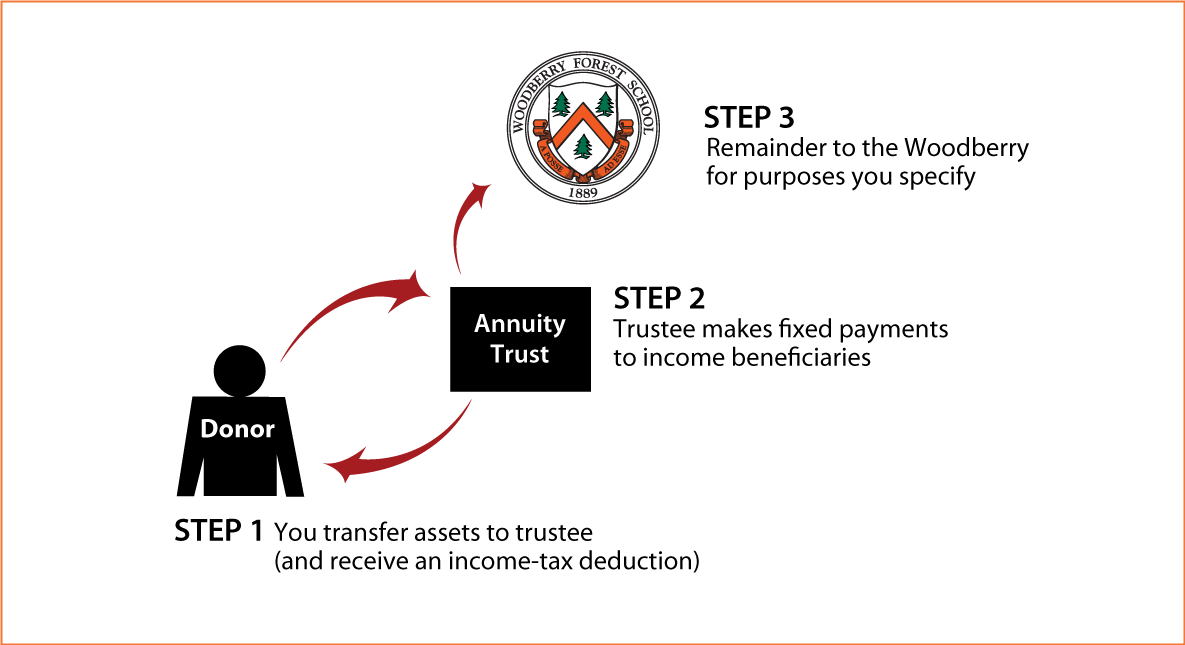

How It Works

- Create trust agreement stating terms of the trust; transfer cash or other property to trustee

- Trustee invests and manages trust assets and makes payments to income beneficiaries you designate

- Remainder to Woodberry for purposes you specify

Benefits

- Payments to one or more beneficiaries that remain fixed for the life of the trust

- Federal income-tax deduction for the charitable remainder value of your interest

- No capital-gain tax when trust property is sold

- Trust remainder will provide generous support for Woodberry

More Information

Request an eBrochure

Request Calculation

Contact Us

Dodie Chavez '85 Federal Tax ID Number: 54-0519590 |

Woodberry Forest School |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer

Woodberry Forest admits students of any race, color, sexual orientation, disability, religious belief, and national or ethnic origin to all of the rights, privileges, programs, and activities generally accorded or made available to students at the school. It does not discriminate on the basis of race, color, sexual orientation, disability, religious belief, or national or ethnic origin in the administration of its educational policies, admissions policies, scholarship and loan programs, and athletic or other school-administered programs. The school is authorized under federal law to enroll nonimmigrant students.