Real Estate—Outright Gift

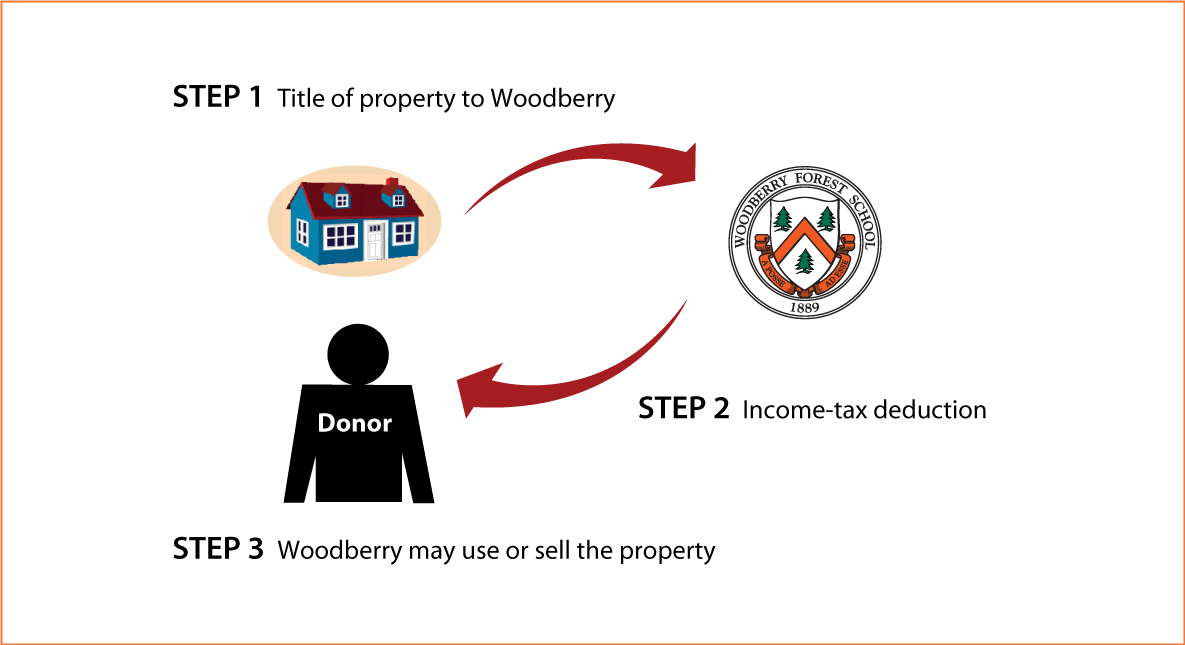

How It Works

- Transfer title of property to Woodberry

- Receive income-tax deduction for fair-market value of property

- Woodberry may use or sell the property

Benefits

- Income-tax deduction for fair-market value of property based on qualified appraisal

- Avoid capital-gain tax on appreciation in value of the real estate

- Relieved of details of selling property

- Significant gift to Woodberry

More Information

Request an eBrochure

Request Calculation

Contact Us

Dodie Chavez '85 Federal Tax ID Number: 54-0519590 |

Woodberry Forest School |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer

Woodberry Forest admits students of any race, color, sexual orientation, disability, religious belief, and national or ethnic origin to all of the rights, privileges, programs, and activities generally accorded or made available to students at the school. It does not discriminate on the basis of race, color, sexual orientation, disability, religious belief, or national or ethnic origin in the administration of its educational policies, admissions policies, scholarship and loan programs, and athletic or other school-administered programs. The school is authorized under federal law to enroll nonimmigrant students.