Gifts from Retirement Plans at Death

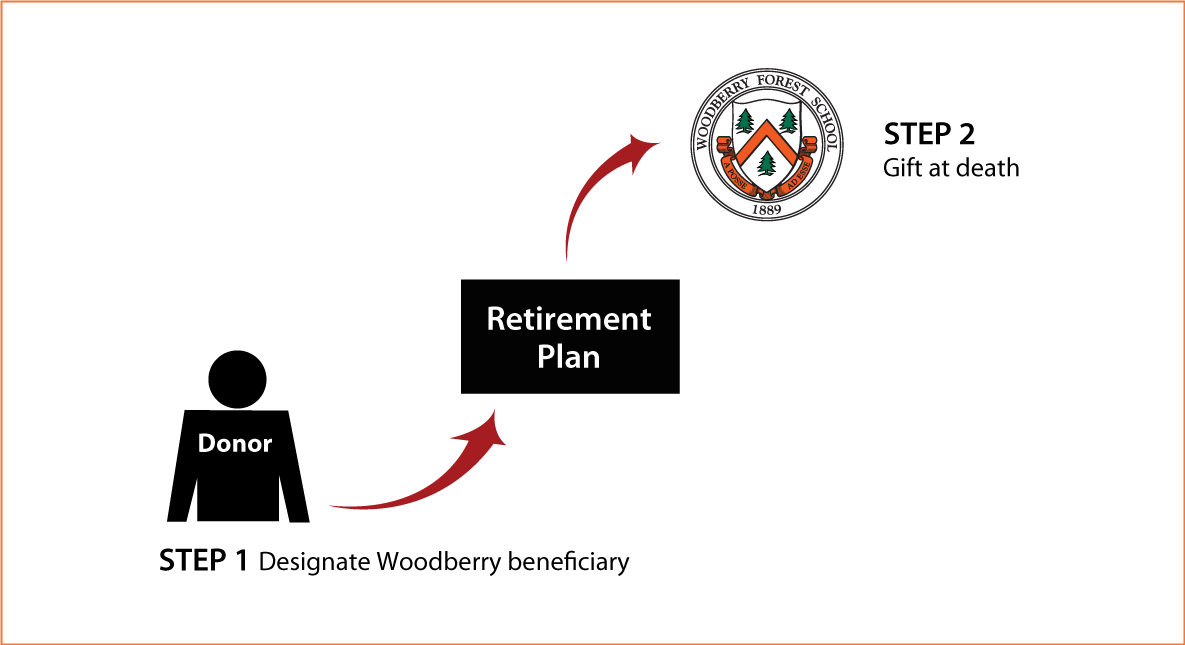

How It Works

- You name Woodberry as beneficiary for part or all of your retirement-plan benefits

- Funds are transferred by plan administrator at your death

Benefits

- No federal income tax is due on the funds that pass to Woodberry

- No federal estate tax on the funds

- You make a significant gift for the programs you support at Woodberry

Special note: Call or e-mail us to tell us of your intent, and we will assist you with the details of the transfer.

More Information

Request an eBrochure

Which Gift Is Right for You?

Contact Us

Dodie Chavez '85 Federal Tax ID Number: 54-0519590 |

Woodberry Forest School |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer

Woodberry Forest admits students of any race, color, sexual orientation, disability, religious belief, and national or ethnic origin to all of the rights, privileges, programs, and activities generally accorded or made available to students at the school. It does not discriminate on the basis of race, color, sexual orientation, disability, religious belief, or national or ethnic origin in the administration of its educational policies, admissions policies, scholarship and loan programs, and athletic or other school-administered programs. The school is authorized under federal law to enroll nonimmigrant students.