Gifts from Retirement Plans

Your retirement-plan benefits are very likely a significant portion of your net worth. And because of special tax considerations, they could make an excellent choice for funding a charitable gift.

Retirement-plan benefits include assets held in individual retirement accounts (IRAs), 401(k) plans, profit-sharing plans, Keogh plans, and 403(b) plans.

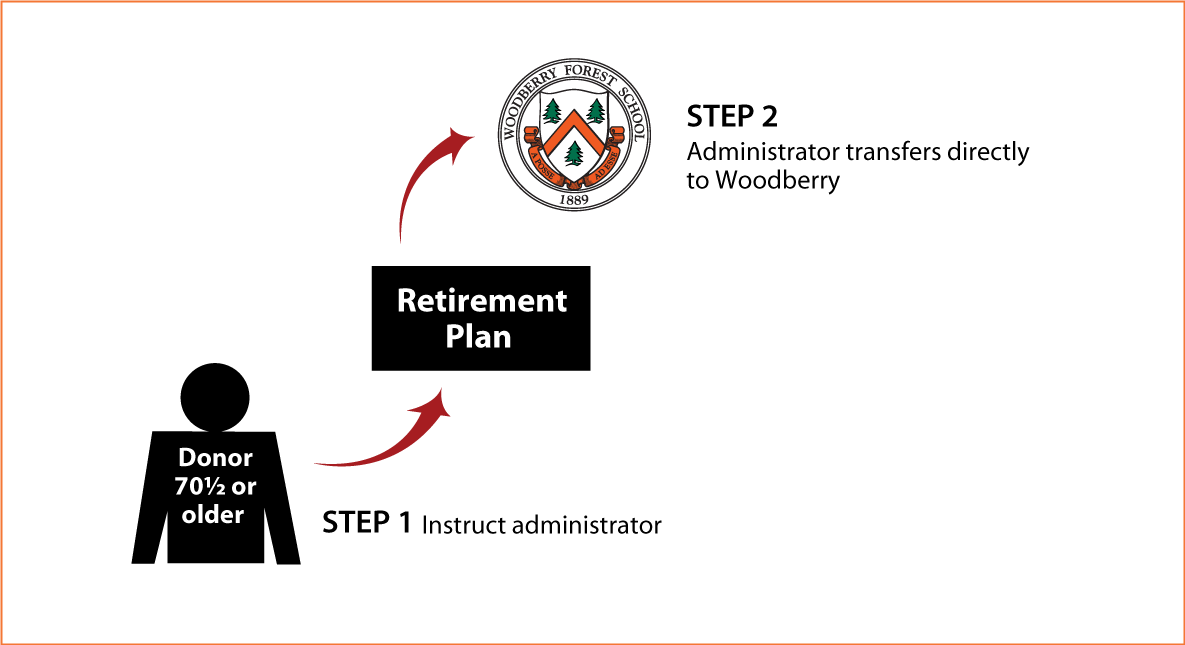

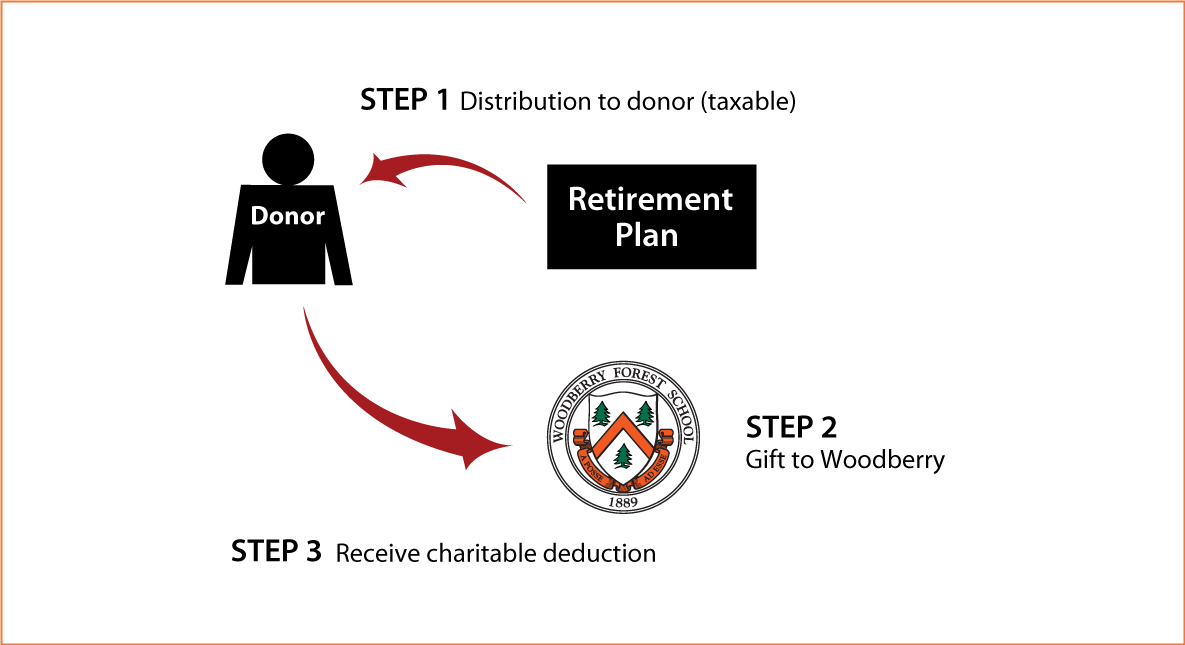

Lifetime Gifts  Click to See Diagram |

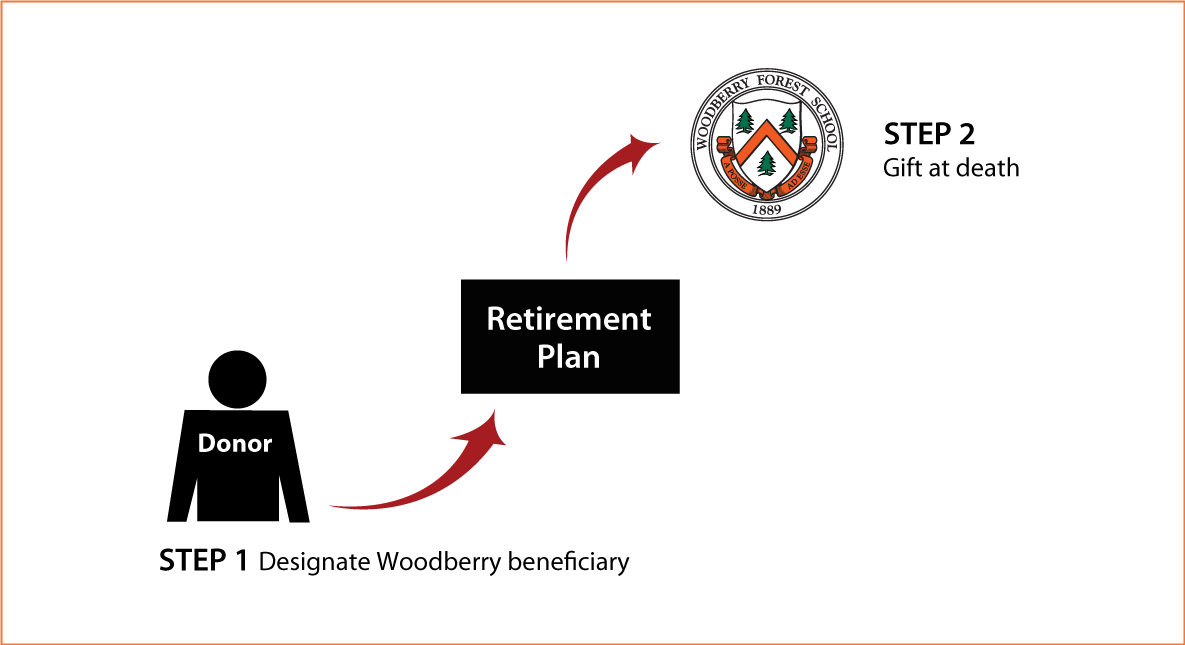

Estate Gifts  Click to See Diagram |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer

Woodberry Forest admits students of any race, color, sexual orientation, disability, religious belief, and national or ethnic origin to all of the rights, privileges, programs, and activities generally accorded or made available to students at the school. It does not discriminate on the basis of race, color, sexual orientation, disability, religious belief, or national or ethnic origin in the administration of its educational policies, admissions policies, scholarship and loan programs, and athletic or other school-administered programs. The school is authorized under federal law to enroll nonimmigrant students.